Google founder Sergey Brin made headlines in early January after the New York Times reported that more than a dozen of his business entities and investments were moved out of California in the final days of 2025. Brin’s moves followed similar high-profile moves by other wealthy individuals, like Peter Thiel and Larry Page, in response to a proposed ballot measure that would retroactively impose a one-time wealth tax on billionaires in the state if approved by voters in November.

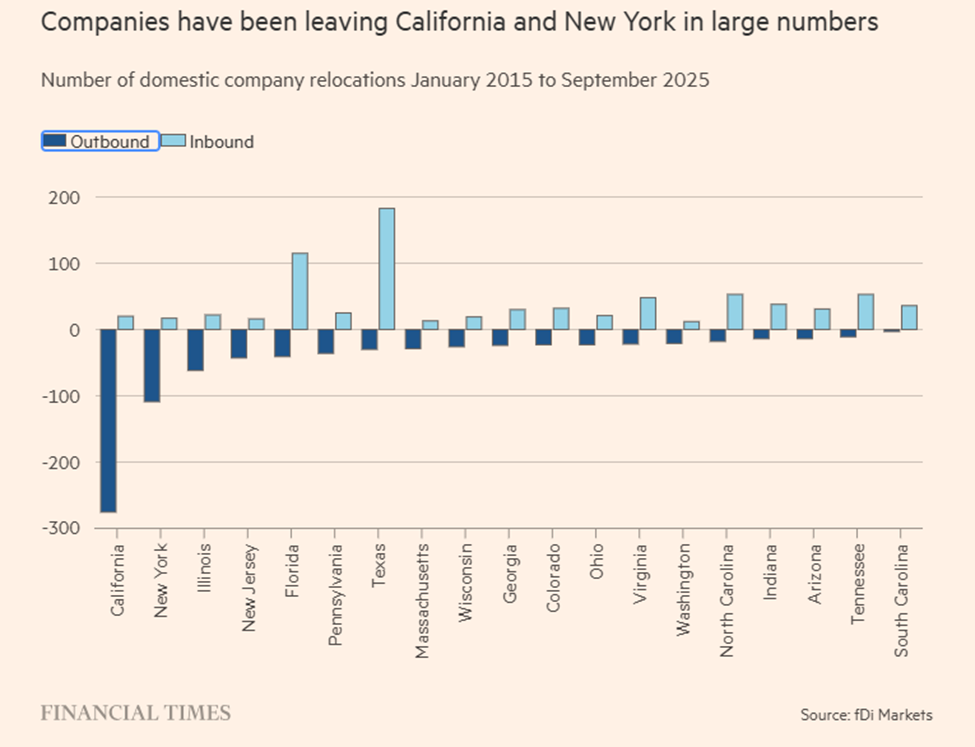

Billionaires are not the only individuals fleeing California. Millions of residents have left the state, in addition to many businesses. Over-regulated states—like California and New York—had the highest net outflow of businesses in the past decade. So, how does bad policy (the kind California and New York are famous for) drive businesses out of state and push residents to move as well? And what are the broader implications for those residents and businesses who do stay?

For some policies, the negative effects for residents are fairly intuitive. High tax rates, for instance, take money directly out of the pockets of the citizens who earned it. With the new proposed ballot measure, California looks like it will repeat the same mistake it made less than 15 years ago when state policymakers and the voters raised marginal income tax rates and sales tax rates with Proposition 30 in 2012. In the immediate aftermath following Prop. 30, residents affected by the tax fled the state at significantly higher rates than the out migration that occurred in the previous 10 years. Similarly, corporate income taxes prevent shareholders from realizing the full gains from their capital.

The negative effects of higher corporate and personal income taxes are deeper and more pernicious than just the money they take out of the economy. These taxes stifle innovation and, in some cases, may drive entrepreneurs out of state. Academic research has shown that personal and corporate income taxes have significant negative effects on innovation in the state, leading to fewer patents issued and fewer inventors residing in the state. Look no further than the decision of Google’s two founders to leave the state where they first started their company decades ago in a different regulatory and tax environment.

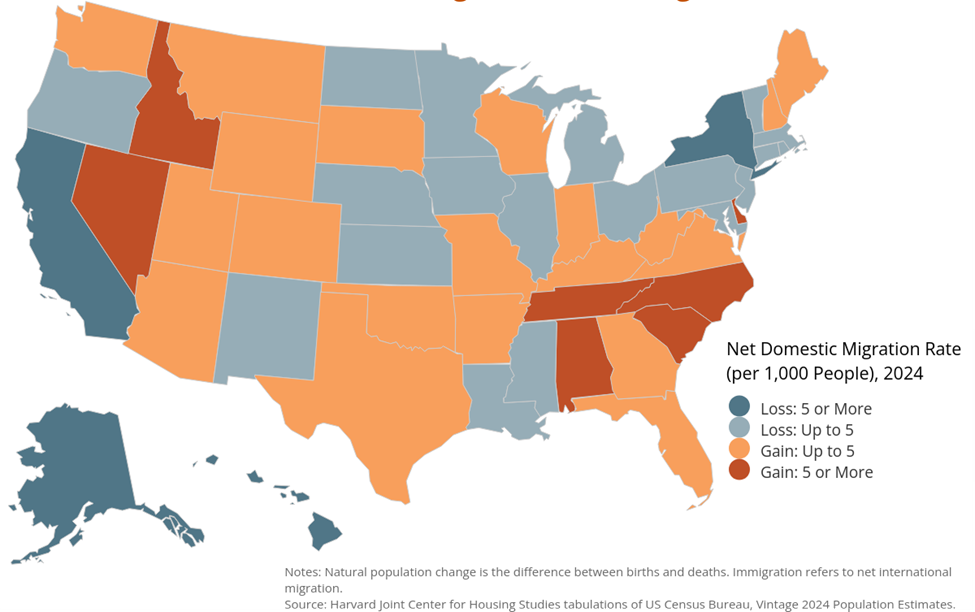

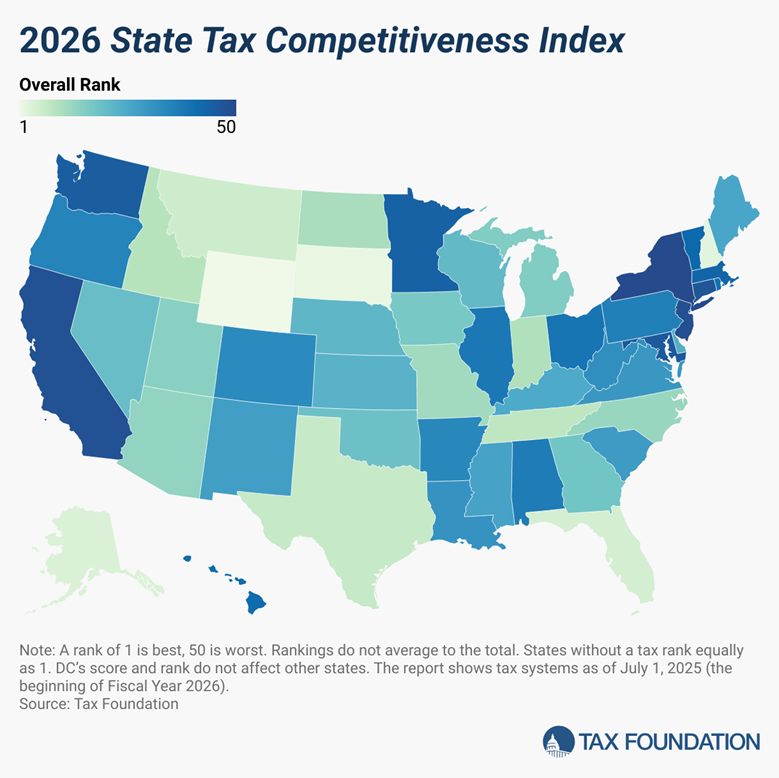

The effects of tax rates on state migration are illustrated in the two graphics above. The Tax Foundation ranks states annually based on tax competitiveness relative to other states. It’s no coincidence that that the states losing residents (as illustrated in the migration map) are those ranked lower by the Tax Foundation for competitiveness.

There are other less visible policies that also contribute to states having a net outflow of residents. Cost of living, cost of housing in particular, is a major reason why people move. While many variables factor into housing costs, abusive zoning, overzealous environmentalism and other regulations have led to housing shortages and higher costs across the board. In California in particular, the zoning process and the California Environmental Quality Act (CEQA) have been weaponized by labor unions, environmental groups, and entrenched business interests to prevent development of new housing and other commercial properties. Occupational licensing also makes it difficult for individuals to move to a new state and continue their careers. As a result, fewer people relocate to states with higher levels of occupational regulations. For businesses, the compliance costs of an increased regulatory burden has substantial negative effects on future sales growth, asset growth, and debt ratios. These negative effects can directly mean fewer positions at the company, lower profits and salaries, and inhibited growth.

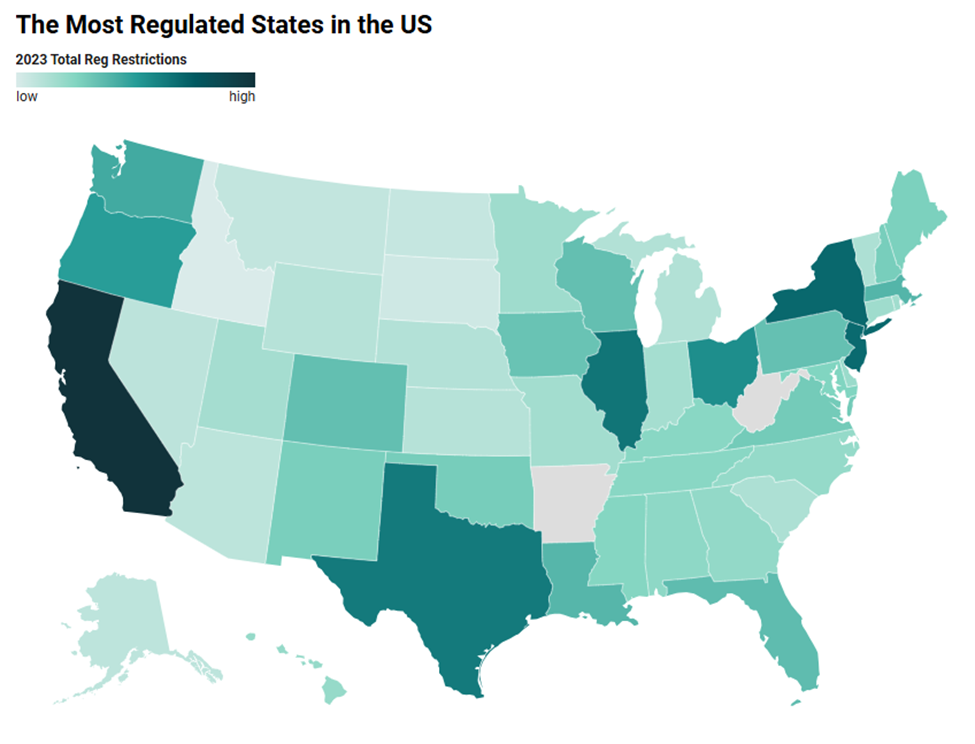

Companies have also fled high regulatory burden states like California and New York over the past decade. In fact, California and New York are ranked first and second, respectively, by the Mercatus Center as the two most regulated states in the US. It should come as no surprise then that both states were also in the top three of states for domestic migration rate out of the state.

Lasting Effects

The long-term effects of over regulation and net migration outflow are disastrous for states and their residents who remain. Previous estimates of the negative effects of federal regulations calculate that the national economy would be more than 25 percent larger if not for decades of burdensome regulations. For states, a similar pattern holds. States that enacted regulatory reform had an average economic growth rate that was 11.7 percent faster than similar states that undertook no reform. This means hundreds of billions of dollars of economic activity are at stake. Limited economic growth means fewer jobs for current residents and fewer job opportunities for out-of-state residents who may be looking to relocate to that state, which can create a death spiral of state migration for those with the worst policies.

Net migration losses also mean lost tax revenue for the state. In the last decade, New York lost $111 billion in net revenue, California lost $102 billion, and Illinois lost $63 billion to interstate migration. Conversely, Forida gained $196 billion, and Texas gained $54 billion over that same period. Even as state migration has slowed down, the effects are felt by states. Arizona, for instance, gained $606 million in revenue in 2025 from the cumulative effects of state migration.

If states want to turn things around and reverse outward migration trends, they must start by embracing free enterprise and relieving the tax and regulatory burdens on residents and businesses located in the state.